VITA

REQUIRED DOCUMENTS AND INFORMATION

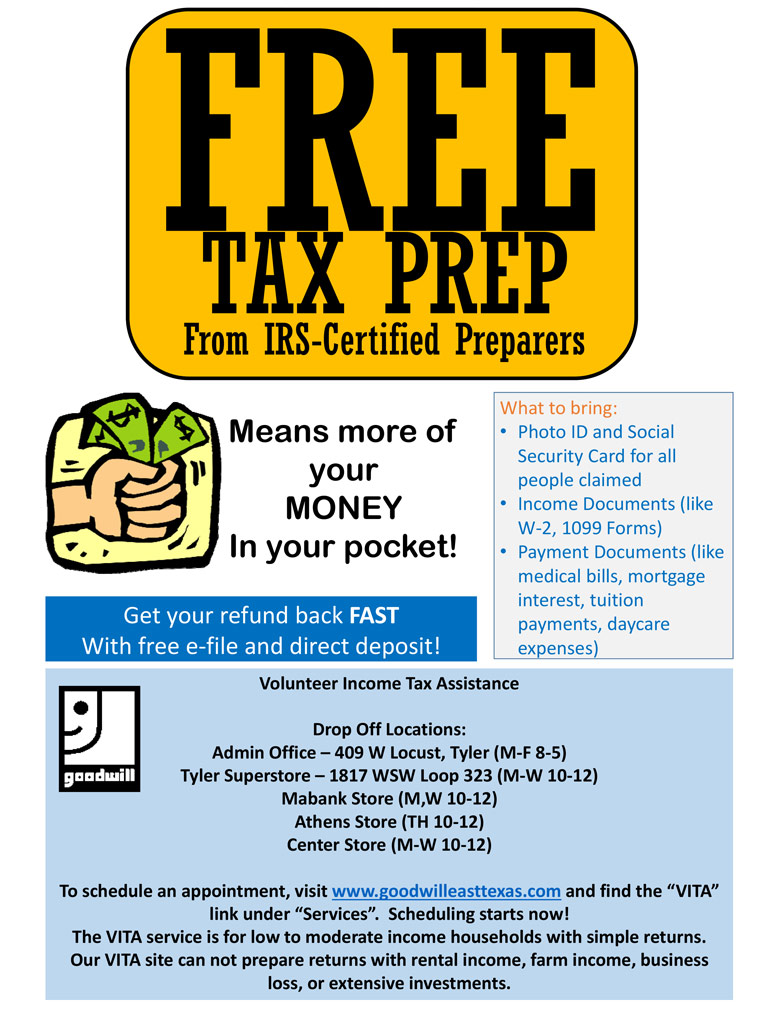

To prepare your income tax return, we are required to obtain your supporting documents. Below you will find a list of what we will need depending on your situation. Be sure that when you drop off these documents (along with the required consent forms listed above) you provide us with a working phone number, in case we have any questions.

- Copy of Social Security Cards for all individuals on the tax return

- Copy of a Photo ID of the taxpayer(s)

- All income documents (W-2, 1099, etc.)

- Form 1098T (if claiming college expenses)

- Total paid to daycare provider and daycare provider’s tax identifying number (such as their Social Security Number or Employer Identification Number)

- Forms 1095-A, B, or C (for Health Insurance)

- Business expenses (if applicable)

- Receipts from charitable donations (if applicable)

- Bank routing number and account number (if you would like to receive a direct deposit)

If you have any questions regarding what documents you will need to provide, you can contact us at (903)593-8438 or email freetaxes@goodwilletx.com